International business regulations are generally similar across countries, but there are significant differences in the details of these rules. Have you ever wondered what happens if a dispute arises between a buyer and a seller in international trade? Which country’s laws would resolve the conflict? Or, on what basis are the buyer’s and seller’s responsibilities defined? Incoterms, or International Commercial Terms, are a set of rules that help resolve these issues. Let’s take a closer look at this important term and how it applies to international trade.

What Are Incoterms?

The word "Incoterms" is a combination of the three words “International Commercial Terms.” The International Chamber of Commerce (ICC) created Incoterms in 1936 to facilitate global trade. Incoterms clarify the buyer’s and seller’s obligations in international transactions, reducing confusion between the parties. These rules are used to determine costs and responsibilities between the seller and the buyer. Both parties involved in a commercial contract must follow the Incoterms specified in their agreement. Incoterms can also be used to understand the terms of a contract and ensure compliance with international regulations.

The International Chamber of Commerce (ICC) regularly updates and revises Incoterms due to changes in global trade environments.

Incoterms have been updated several times over the years, including in 1953, 1967, 1976, 1980, 2000, 2010, and most recently, 2020.

Categories of Incoterms

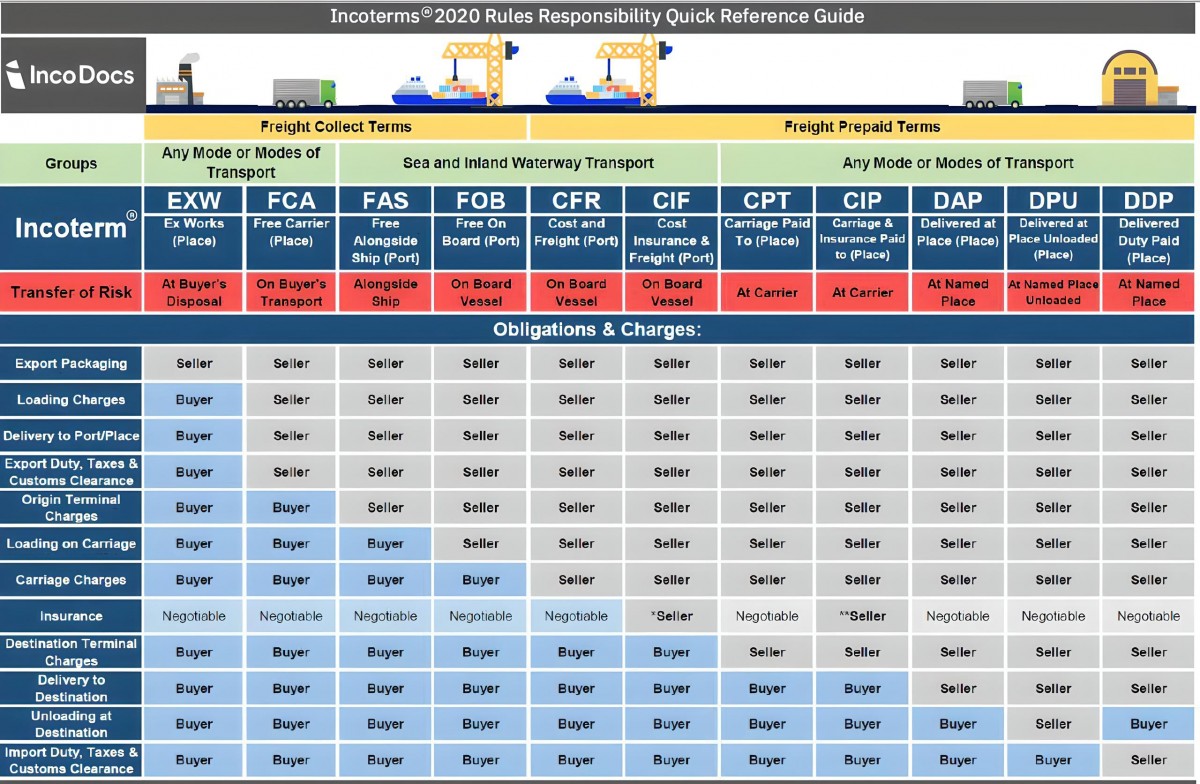

In Incoterms 2020, the rules are divided into two main categories:

- Rules for all modes of transportation: These include EXW, FCA, CPT, CIP, DPU, DAP, DDP.

- Rules for maritime transport only: These include FAS, FOB, CFR, CIF.

Now, let's dive deeper into each of these terms:

FCA (Free Carrier): Delivery at a designated location to the carrier in the seller's country

In this case, the seller’s responsibility ends once the goods have passed export clearance and are handed over to the carrier. The buyer determines who the carrier is and where the goods should be delivered. Once the seller hands over the goods to the carrier, they are no longer responsible. From that point, all risks and responsibilities fall to the buyer.

The key risk factor in this process is during transportation. All costs related to transport and insurance are the buyer's responsibility.

FAS (Free Alongside Ship): Delivery alongside the ship

In this case, the seller’s responsibility ends once the goods are delivered alongside the ship at the dock. All costs related to transportation, insurance, and inspection of the goods are the buyer’s responsibility. Any risks of damage to the goods during loading and transport are also the buyer's responsibility.

This term is only applicable to sea or inland waterway transport.

FOB (Free On Board): Delivery on board the ship

The seller fulfills their obligation when the goods are loaded onto the ship at the designated loading port. From this point, the buyer takes on responsibility for all costs and risks related to the goods, including damage or loss.

All costs related to transportation, insurance, and inspection are the buyer's responsibility. This term is specifically for sea transport.

CFR (Cost and Freight): Price of goods and freight to the destination port

Under this rule, the seller completes the delivery once the goods are loaded onto the ship at the port of departure, and they pay for the transport to the destination port. This rule is a renamed version of the older C&F rule.

It’s advisable to specify both the departure and destination ports in the contract.

CIF (Cost, Insurance, and Freight): Price, insurance, and freight to the destination

This term applies only to sea transport. The seller hands over the goods to the shipping company after loading them onto the ship. The seller is responsible for paying the shipping costs, insurance, and other standard charges until the goods reach the destination port. However, the seller is not responsible for the risks associated with the goods after they have been loaded onto the ship.

The seller must arrange for insurance coverage, but the risk of damage or loss after loading is transferred to the buyer.

CPT (Carriage Paid To): Delivery with carriage paid to the destination

The seller delivers the goods to a carrier they have selected, paying the shipping costs to the agreed destination. However, the buyer assumes the risk of the goods once they are handed over to the carrier.

All costs for insurance and customs are the buyer's responsibility.

CIP (Carriage and Insurance Paid To): Delivery with carriage and insurance paid to the destination

This rule is best for combined transportation. The seller is responsible for paying both transport and insurance costs until the goods reach the agreed destination. The buyer assumes the risk of the goods once they are handed over to the carrier.

DPU (Delivered at Place Unloaded): Delivery at a specified destination with unloading

In this case, the seller delivers the goods to the agreed destination and is responsible for paying all related costs, including transportation, unloading, and terminal fees. Once the goods are unloaded, the buyer is responsible for any additional costs and risks.

DAP (Delivered at Place): Delivery at a specified destination, ready for unloading

The seller arranges for transportation and delivery of goods to the specified location. However, taxes and insurance are not the seller’s responsibility in this rule.

DDP (Delivered Duty Paid): Delivery at the destination, including duties and taxes

The seller is responsible for delivering the goods to the agreed location and paying all costs, including duties, taxes, and customs fees.

Changes in Incoterms 2020

As of January 1, 2020, all international trade activities are governed by the latest Incoterms, Incoterms 2020.

Key changes in Incoterms 2020 compared to Incoterms 2010 include:

- DPU replaces DAT: In Incoterms 2020, the term DPU (Delivered at Place Unloaded) replaced DAT (Delivered at Terminal). The change was made to remove ambiguity, as the term "terminal" was unclear.

- Insurance requirements: In Incoterms 2010, the seller was only required to insure the goods under Clause C (minimum insurance), but under Incoterms 2020, the seller must insure the goods under Clause A (comprehensive insurance).

Incoterms 2020 Table

The Incoterms 2020 table lists in detail the division of responsibilities, costs, and risks between the seller and the buyer. Buyers tend to favor terms lower on the table, while sellers prefer terms higher up for better control over costs and risks.

What Does Incoterms Cover?

Incoterms applies specifically to sales contracts. It outlines the rights and obligations between the buyer and seller. However, it does not cover:

- The characteristics of the goods being sold, including the timing, method, and payment currency.

- Export and import restrictions.

- Intellectual property ownership and transfer.

- The impact of unforeseen events (force majeure) on the performance of responsibilities.

The Consequences of Not Knowing Incoterms

Every trader must stay updated on Incoterms, as these rules are designed to make international trade smoother and less prone to disputes. By understanding Incoterms, traders can avoid misunderstandings and engage in international trade more confidently and efficiently.

Incoterms Explained

EXW (Ex Works): Under Incoterms 2020, EXW means that goods are delivered at a location designated by the seller, such as a warehouse, factory, or office. The buyer assumes all responsibilities from the point of delivery, including transportation, insurance, customs, and any risks associated with the shipping process.

It’s essential to specify the exact delivery location in the contract to minimize risks for the buyer. The phrase "ex works" should be used carefully, as it’s better translated as "delivery at the agreed location without export clearance."